- Article

- Infrastructure and Sustainable Finance

- Transition to Net Zero

HSBC Sustainability Pulse Survey

A new era of business growth?

In an ever-evolving global landscape, identifying the right growth lever is vital to staying ahead. The HSBC Sustainability Pulse Survey 2025 demonstrates that businesses and institutional investors today view sustainability as a key strategic consideration with 95% of corporates viewing sustainability as a commercial opportunity, and 99% saying they expect it to drive differentiated competitive advantage over the next three years.

It identifies key factors positioning sustainability as a growth catalyst and highlights businesses who are redefining norms and spearheading sustainability efforts. Additionally, it explores the convergence of climate technology and innovation in driving sustainable development and the alignment between institutional capital and corporate transition goals.

Sustainability Pulse Survey

- Global Report

- HSBC Sustainability Pulse Survey - Asia Regional Report

- HSBC Sustainability Pulse Survey - European Regional Report

- HSBC Sustainability Pulse Survey - Mexico Insights (English version)

- HSBC Sustainability Pulse Survey - Mexico Insights (Spanish version)

- HSBC Sustainability Pulse Survey - UAE Insights

- HSBC Sustainability Pulse Survey - US Insights

Today sustainability strategy has become business strategy: defining value creation, competitive advantage and risk management – as demonstrated by our survey. This critical pivot is why we’ve launched our new ambitious strategy to support our clients with their transition – talk to us today.

Key insights

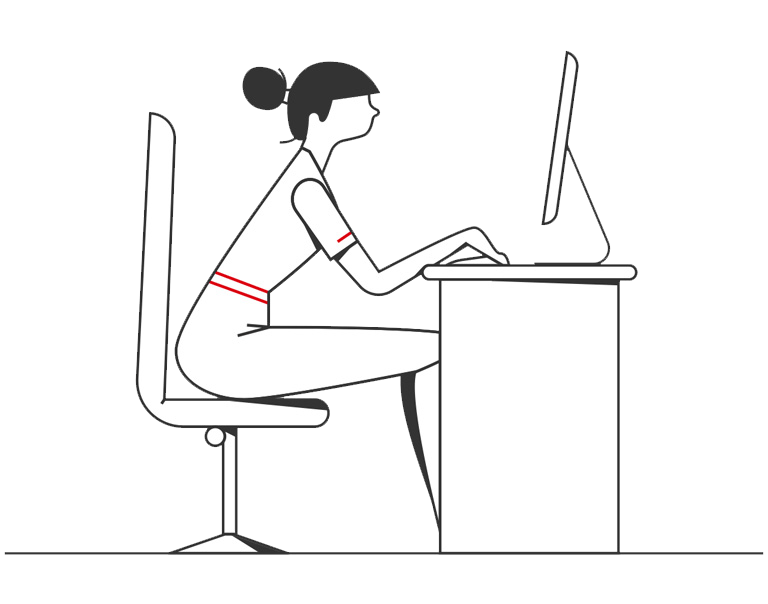

Climate transition as a strategic priority

Businesses and investors tell us that they recognise the importance of climate transition for competitive advantage and long-term resilience. 95% of corporate business leaders and 79% of institutional investors view sustainability as a growth driver.

Integration of climate technology

63% of companies surveyed, said they were advanced adopters across multiple climate technologies and will continue to expand their adoption to support their transition.

Sectoral and regional leadership

The Commercial Real Estate and TMT sectors are leading in technology adoption, while Asian markets like Indonesia, Singapore and India are planning to accelerate their sustainability ambition and execution over the next three years.

Investor alignment and confidence

Institutional investors are aligning with corporate sustainability strategies, driven by long-term financial performance and risk management, suggesting that investor confidence remains strong.

Conclusion

Our survey tells us that companies and investors alike are aligning on the importance of climate transition as a driver of competitive advantage and long-term resilience. This momentum is supported by the recognition of technological opportunities and robust capital allocation patterns, demonstrating a commitment to sustainable investment. Despite some financial barriers, the demand for scalable climate technologies presents significant opportunities for innovation and investment, helping companies to potentially turn transition strategies into a fundamental aspect of business transformation and growth.

Sustainability Pulse Survey

- Global Report

- HSBC Sustainability Pulse Survey - Asia Regional Report

- HSBC Sustainability Pulse Survey - European Regional Report

- HSBC Sustainability Pulse Survey - Mexico Insights (English version)

- HSBC Sustainability Pulse Survey - Mexico Insights (Spanish version)

- HSBC Sustainability Pulse Survey - UAE Insights

- HSBC Sustainability Pulse Survey - US Insights

This report presents insights from two comprehensive surveys conducted in September 2025. The first survey captured perspectives from 1,651 senior business decision makers responsible for sustainability across companies in 12 global markets (Australia, France, Germany, Hong Kong, Mainland China, India, United Kingdom, Indonesia, Mexico, Singapore, UAE and the USA), conducted between 17th and 26th September 2025. The second survey gathered insights from 500 global institutional investors, conducted between 22nd September and 26th September 2025. Both audiences completed quantitative online surveys designed specifically for their respective sectors. All responses were collated and followed by detailed investigation into key themes emerging from the findings. Because of rounding of percentages, some sums may not equal 100%.

How sustainability is unlocking a new era of business growth

The HSBC Sustainability Pulse Survey explores how the climate transition is helping unlock a new era of business growth.

Further insights

Globalisation of Climate Tech: A defining growth opportunity of our generation

The world has entered a new era of industrial transformation — one defined by the global retooling of economies for a low-carbon future. This isn’t a niche investment theme; it’s a reallocation of capital, resources, and innovation on a scale unseen since the mid-20th century industrial boom.

Blending financing and sustainability for SFP Sons

An Indian perfume manufacturer, SFP Sons, is leading the way in sustainable manufacturing by connecting its funding to its ESG performance with HSBC’s innovative Sustainability Improvement Loan (SIL).

New energy needs storage systems and stable policies

Energy storage facilities, better transmission infrastructure and stable policies are needed to meet increasing electricity demand.

HSBC Treasury Pulse Survey

Our latest Treasury Pulse report delves into how treasuries worldwide are addressing these challenges