- Article

- Business Finance

- Managing cash flow

- Managing risk

Businesses determined to grow despite headwinds

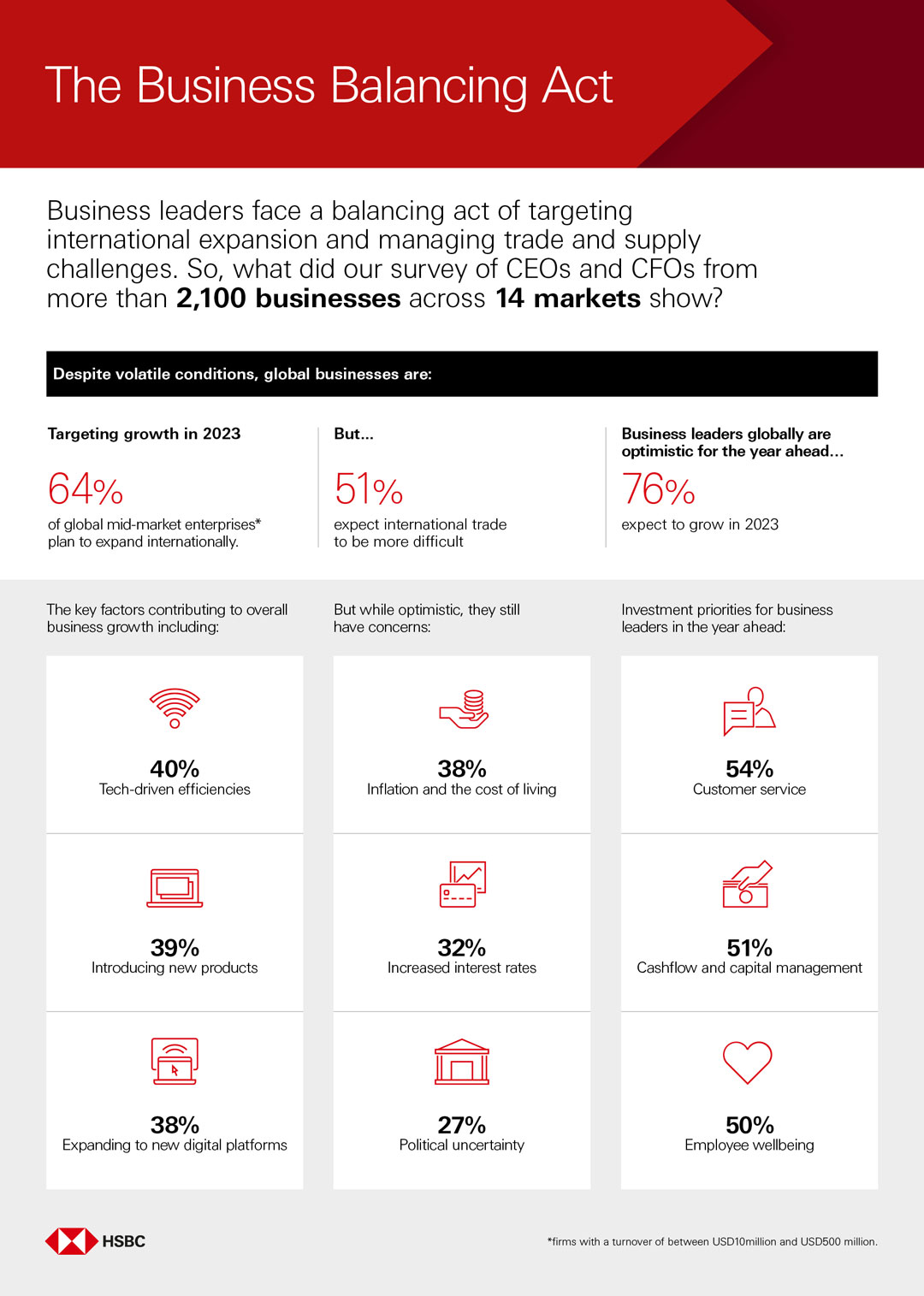

New research among global mid-market enterprises (MMEs) – firms with a turnover of between $10 million and $500 million – has found determination among them to grow in 2023.

Two-thirds (64%) of MMEs polled for our Business Balancing Act study say they plan to expand internationally in 2023.

The survey of CEOs and CFOs from more than 2,100 businesses across 14 markets around the world found they are targeting growth by entering at least one new foreign market, despite half (51%) saying they expect international trade to be more difficult.

The data also reveals three quarters (76%) of MMEs are expecting to grow next year, in spite of global economic headwinds.

The relative positivity shown by businesses is set against a backdrop of concern regarding inflation and the cost of living (38%), increased interest rates (32%) and for many markets, political uncertainty (27%).

The research – carried out for HSBC by polling company Toluna - found that businesses expect technology-driven efficiencies and the expansion to new digital platforms and channels to be two of the major growth drivers, demonstrating business leaders’ continued emphasis on digital and innovation.

More than a third of those polled said increasing domestic demand and the ever-growing prioritisation of sustainability will also play vital roles.

Growing while managing volatility

Yet beneath the ambitious forecasts, MMEs are facing a balancing act between finding opportunities to drive growth and managing a combination of challenges in the year ahead:

- Half (49%) of leaders will focus on making their supply chain more sustainable, but at the same time over a third are concerned there are a lack of quality suppliers and goods (36%).

- 39% will introduce new products and services to push for growth, but a decrease in demand and consumer spending are cited as top concerns.

Businesses are operating in an increasingly complex global economic landscape, navigating a wide range of challenges from soaring inflation to rising interest rates. Despite this, there is a strong sense of global resilience and ambition amongst mid-size businesses as they zero in on growth in 2023.

|

Barry O'Byrne also said that: "Our study shows that they are also looking to expand into new markets, improve sustainability and launch new products. New technology and access to finance are expected to be the twin-engines of growth for businesses in the short and long-term."

Investing to grow

The study, which surveyed businesses in Australia, Mexico, Singapore, UAE, UK, US, mainland China, Hong Kong SAR, India and Germany, among others, also found that 40% of MMEs are seeking external investment to support their growth. This increases to 51% for businesses in Asia Pacific, compared to 30% in the Americas and 29% in Europe.

When asked how business leaders would prioritise investment for the next 12 months, customer experience (54%), cash flow and capital management (51%), and employee well-being (50%) top the list. These investment plans, however, are balanced by 56% of MMEs looking at how they can cut costs next year.

Find out how HSBC can help your business grow by ensuring you can get paid, pay your bills and manage your liquidity across multiple currencies and countries by clicking the button below.

The Business Balancing Act survey was conducted by industry research firm Toluna between 28th September and 24th October. Toluna polled 2,170 financial decision makers at mid-market enterprises in 14 markets UK (316), US (191), Australia (106), Canada (104), Germany (203), France (198), India (220), Indonesia (167), Malaysia (171), Mexico (113), Singapore (114), UAE (82), mainland China (109), Hong Kong SAR (76) using its online survey/panel.